7 Steps to Achieve Financial Freedom in 2025: Proven Strategies to Build Wealth and Security

64% of Americans can’t cover a $1,000 emergency—but financial freedom is closer than you think.” This shocking statistic underscores a troubling reality. But here’s the good news: You don’t need to be rich to be free. The journey to financial freedom is achievable for anyone with the right plan.

At financekd, we believe financial freedom means more than just having money. True financial independence is when your savings or passive income sustain your lifestyle, freeing you from the need to earn a pay check.

Unlike being rich—which often centres around luxury—financial freedom is about control, peace of mind, and opportunity.

Why does this matter in 2025 more than ever?

- Reduced stress and anxiety about money.

- Freedom to pursue your passions and take career risks.

- Creating generational wealth for your family.

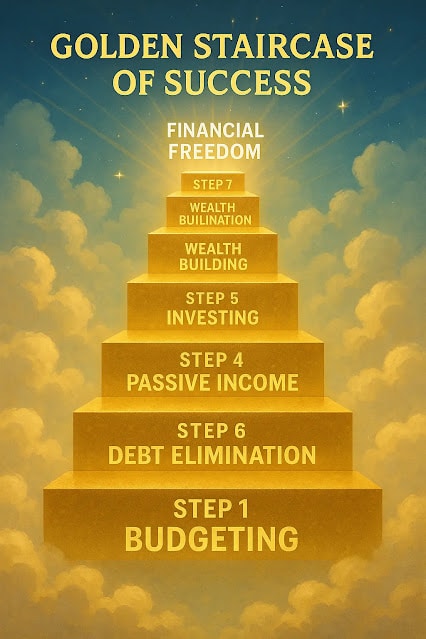

Let’s dive into the 7 steps to achieve financial freedom this year, with insights, tools, and actions you can start today.

Step 1: Shift Your Money Mindset

Why Your Mindset is the Foundation of Financial Freedom

The journey begins in your mind. If you’re stuck in a scarcity mindset (“I’ll never have enough”), your actions will reflect fear and limitation. A mindset of abundance, on the other hand, promotes growth, optimism, and confidence in your financial future.

Case Study: Lisa, a 32-year-old teacher, was stuck living paycheck to paycheck despite earning a decent income. Her breakthrough came when she realised she was sabotaging herself with daily impulse purchases. By journaling her “money wins” daily, she shifted from reactive to intentional spending.

Actionable Tip: Start a daily money journal. Each night, write down one financial decision you made well—no matter how small. This rewires your brain for financial success.

Step 2: Audit Your Finances Ruthlessly

Know Exactly Where Your Money Goes

You can’t improve what you don’t measure. A ruthless audit of your finances reveals the truth behind your spending habits. Use tools like Mint or Personal Capital to categorise and track every dollar.

Look for spending leaks, like:

- Unused subscriptions

- Frequent takeout

- Forgotten memberships

Pro Tip: Follow the 50/30/20 Rule:

- 50% to Needs (rent, food, utilities)

- 30% to Wants (travel, dining, hobbies)

- 20% to Savings/Debt Repayment

Step 3: Crush Debt with the “Debt Avalanche” Method

Eliminate Debt Faster and Save Thousands

Debt is the biggest barrier to financial freedom. The Debt Avalanche Method focuses on paying off high-interest debt first, saving you the most money over time.

Debt Avalanche vs. Debt Snowball:

| Method | Focus | Advantage |

|---|---|---|

| Avalanche | Highest interest | Saves more money |

| Snowball | Smallest balance | Quick wins, motivation |

Example: Jacob had $20,000 in credit card debt at 22% APR. By prioritising the highest-interest account and making extra payments, he became debt-free in 18 months—saving over $4,000 in interest.

Use this debt calculator to plan your payoff journey.

Step 4: Build a Fortress Emergency Fund

Why 3–6 Months of Savings Isn’t Enough (And What to Do Instead)

The traditional emergency fund guideline isn’t enough in today’s uncertain world. Instead, use a tiered approach:

- Tier 1: $1,000 starter fund for immediate needs (repairs, small emergencies).

- Tier 2: 3–6 months of essential expenses (rent, food, insurance).

- Tier 3: 12+ months—your “Freedom Fund” to enable bold decisions like quitting a toxic job.

Where to Save:

- High-Yield Savings Accounts (HYSA): Ally Bank, Marcus by Goldman Sachs

- Short-Term Certificates of Deposit (CDs)

Step 5: Invest Like a Millionaire

Passive Income Streams That Build Wealth Automatically

Investing is non-negotiable for financial freedom. Even a small investment today can outgrow a larger one tomorrow, thanks to the magic of compounding.

Key Investment Vehicles:

- Stocks: Low-cost index funds (e.g., Vanguard VTI, Fidelity FXAIX)

- Real Estate: Start with REITs or look into rental properties.

- Side Hustles: Sell on Etsy, start a YouTube channel, or create digital products.

Step 6: Maximize Income with “Skill Stacking”

How to 10X Your Earnings Without Burning Out

Increasing your income exponentially doesn’t require a second job—just smarter use of your skills.

Skill Stacking: Combine multiple complementary skills to increase your market value.

Tactics:

- Earn certifications (e.g., Google Ads, HubSpot)

- Start a freelance side hustle (try Upwork or Fiverr)

- Monetise your passion: Create digital courses, ebooks, or start a blog

Case Study: Sarah, a full-time teacher, started blogging about personal finance. Within 12 months, she was making $5,000/month from affiliate links and digital products.

Step 7: Protect Your Wealth and Automate

Guard Your Freedom with Insurance and Systems

Freedom is fragile without protection. Safeguard your finances and remove friction by automating key systems.

Must-Have Insurance:

- Term life (for income replacement)

- Disability insurance (in case of illness)

- Umbrella policy (liability protection)

Automation Checklist:

- Auto-transfer to savings/investment accounts

- Auto-pay recurring bills

- Annual financial checkup: Update goals, rebalance portfolio

Bonus: 5 Financial Freedom Mistakes to Avoid

- Over-frugality

- Fix: Allocate a “guilt-free” spending budget to enjoy life.

- Ignoring inflation

- Fix: Invest in assets that outpace inflation, like stocks and real estate.

- Skipping estate planning

- Fix: Explore platforms such as Trust & Will to seamlessly create and organise your will with ease and security.

- Lifestyle creep

- Fix: Increase savings as income rises.

- Following trends blindly

- Fix: Stick to time-tested financial principles.

Conclusion

Financial freedom goes beyond just crunching numbers; it’s about nurturing the right mindset, creating sustainable systems, and maintaining unwavering consistency. Whether you’re buried in debt or just starting your journey, the 7 steps to achieve financial freedom provide a proven roadmap for wealth and security.

At financekd, we’re here to empower your journey with tools, guides, and real-life success stories.

Remember: “Financial freedom is a journey—start walking!“

Know someone stuck in debt or overwhelmed by finances? Share this guide and help them change their future.